Low interest loans,

Double-digit savings interest

Fueling the dreams of 50k+ individuals and small businesses! Experience the magic of our single digit interest loans, unbeatable savings interest rates, and a pledge to deliver with speed, integrity, and empathy.

Take control of your money

Manage your finances,

all in one place

Send and receive

from anywhere

Explore Payments

Get smart instant loans

at low interest rates

Automated Savings

Explore Monipot

Get smart instant loans

at low interest rates

Explore Monibac Loans

Send and receive

from anywhere

Explore Payments

Unmatched interest

rates on savings

Learn more about MoniLock

Automated

savings

Explore MoniPot

Get smart instant loans

at low interest rates

Explore Monibac Loans

Easy Access to Loans

Get the funds you need quickly and without hassle, with our straightforward loan application process.

24/7 Customer Support

Our dedicated support team is available around the clock to assist you whenever you need help.

Fast transaction Speed

Enjoy swift and efficient transactions, ensuring your money moves when you need it most.

High Interest on Savings

Maximize your savings with competitive interest rates that help your money grow faster.

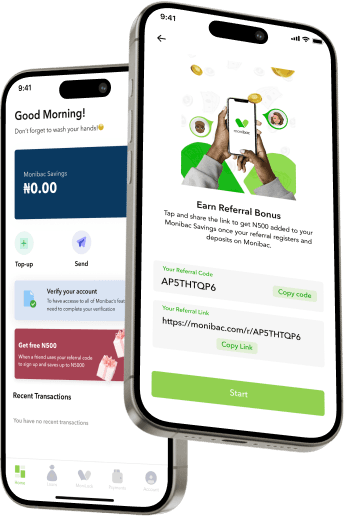

Join 50,000+ happy Monibac users worldwide

Streamline your finances

in 3 easy steps

Create an account

Sign up with personal details

Fund your wallet

Add money via bank transfer or card

Watch your money grow

Choose a product and sit back

Frequently asked questions

Frequently asked

questions

You can simply request for a loan by following these basic steps:

- - Install the Monibac App from Playstore and create an account

- - Start saving (maintain an active savings balance)

- - After 3 months, you are eligible to request for a loan of up to 50% of your total savings

- - Loan request is made by simply submitting basic KYC details on the application and selecting the duration of the loan.

- - Monibac receives loan request and validates KYC documentations against your Monibac profile.

- - Monibac approves request and your offer letter is sent to your email for acknowledgement

- - Your Monibac is credited with your loan amount after acknowledgement

Monibac offers single digit interest loans at :

- - 9% for 90 days

- - 15% for 180 days

Monibac is a safe and secure platform that offers the following benefits:

- - You do not need a collateral before you can access a loan

- - There are no charges on both deposits and loans.

- - You can get an additional 50% of your savings as loan.

- - You can get from 20,000NGN to 500,000NGN as loan

- - We will always send reminders for your repayment without much disturbance.